Are you willing to dive into the planet of product trading? If so, then it’s time to learn about indexsp: .inx. This powerful tool can help you easily navigate the complex and unpredictable waters of the stock market. Whether you’re a seasoned investor or just getting started, this blog post is your guide to understanding how indexsp: works and how it can benefit your portfolio. So sit back, relax, and prepare to take on Wall Street like a pro!

What is indexsp?

Index investing is a type of passive investing that involves investing in a basket of stocks that track a particular index. Indexes are often used to measure the performance of a particular market or sector and can be used as benchmarks for active investors.

Index funds are a famous way to invest in indexes and are often sold as low-cost alternatives to actively ordered accounts. Exchange-traded funds (ETFs) are another class of index buy car and can offer even lower costs and grander flexibility than traditional index accounts.

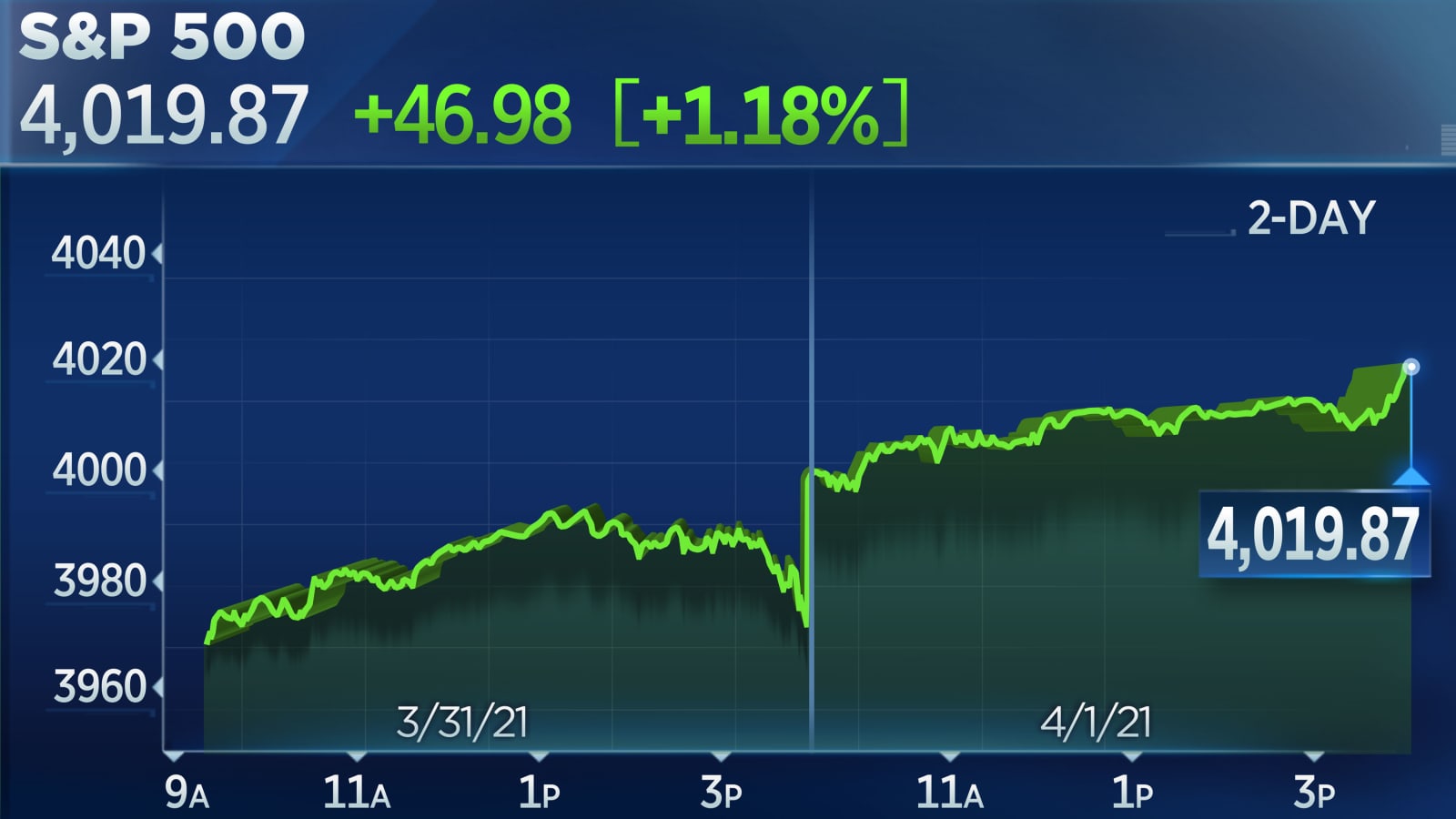

Indexes can be much diversified or concentrated on a specific need or sector. Some famous indexes include the S&P 500, which tracks the 500 biggest corporations by need capitalization recorded on U.S. businesses, and the Dow Jones Industrial Average (DJIA), which shields 30 low-chip products sold on the New York Stock Exchange (NYSE).

Many different indexes are available to investors, and choosing the right one will depend on your investment goals and objectives. Indexes can be useful for building a well-diversified portfolio and help you stay disciplined in your investment strategy.

How does indexsp job?

Index investing is simple: Instead of picking stocks, you buy an entire stock market index. That gives you instant diversification and stops the requirement to select individual champions. Over the long haul, indexes outperform most mutual funds and personal products.

There live two main kinds of indexes: capitalization-weighted and equal-weighted. In a capitalization-weighted index like the S&P 500, the largest firms account for a larger slice of the pie. That’s because their store costs have risen more than fewer groups. As a result, these mega-cap stocks have greater influence over the index’s direction.

An equal-weighted index such as the S&P 500 Equal Weight Index holds the same digit of shares of each company in the index. If one store doubles in price while all others stay flat, its weight in the portfolio will fold. This indexing method gives small-cap stocks more sway than in a cap-weighted index like the S&P 500.

Currently that you understand how indexes work, let’s peek at some of the gifts they present investors:

1) Diversification – When buying an index fund, you get Instant diversification across hundreds or thousands of different stocks or other securities. For sample, the SPDR S&P 500 ETF (SPY), which follows the S&P 500 Index,

The benefits of indexsp

When investing in the stock market, people can use many different strategies. Nevertheless, one strategy that has gained rage in recent years is investing in index funds.

Index funds are investment funds that track a specific financial market index, such as the S&P 500. Index accounts offer several blessings for investors, including:

1. It shows investors a low-cost way to invest in various products and other protection fields.

2. Low Expenses: Index funds typically have lower expense ratios than actively collected funds, which means more of your money goes towards investment development.

3. Passive Investment: Index funds are a passive investment option, requiring less maintenance than other types of investments.

If you’re considering investing in the stock market, index funds should be considered part of your overall strategy.

The risks of indexsp

Regarding the stock market, investors can use many different options and strategies. One popular strategy is investing in index funds, which can provide diversification and a way to track the overall market’s performance. Nevertheless, there are also some risks associated with financing in index funds.

One risk is that index accounts are often laboriously weighted towards large companies. If the stock market declines, index account investors could see significant failures. Additionally, because index funds are not actively managed, they do not have the same potential for outperforming the market as other investment strategies.

Another chance to view is that index funds can be costly. Some indexes, such as the S&P 500, require investors to pay a higher fee to gain access. Additionally, because index funds are often traded on exchanges, investors may have to pay commissions when buying or selling shares.

Despite these risks, index funds can still be a helpful tool for investors seeking diversification and tracking the stock market. Index funds can be valuable to any portfolio for those willing to accept the risks.

How to use indexsp

There are a few other forms that investors can use indexsp: .inx to navigate the stock need. The foremost form uses indexsp to follow the performance of a sure stock need index. This can be useful for investors wanting to know how the overall market performs. Another way to use indexsp is to look up individual stocks traded on indexsp: .inx. This can be helpful for investors who are looking for exact details about a particular store. Finally, investors can use indexsp: .inx to create their custom portfolios. This can be useful for investors who want to track the performance of their portfolio or for investors who want to create a portfolio tailored to their own investment goals.

What is indexsp: .inx

Indexsp. in is a stock need index that measures the commission of stocks in the S&P 500 Index. The index is calculated by bearing the standard of the prices of the 500 stores in the S&P 500 Index.

Maximizing Your Investment Prospect with indexsp: .inx

When it comes to investing, there are a lot of other strategies that people use to try and earn cash. Some people prefer individual products, while others invest in mutual accounts. However, index investing is another option many people don’t know about.

Index investing is investing where you put your money into an index fund, a collection of stocks tracking a certain market index. For sample, the S&P 500 is a famous index in many investments. By investing in an index fund, you essentially invest in all 500 companies that comprise the S&P 500.

One of the biggest benefits of index funding is that it’s a very low-risk way to help. Since you are diversified across so many other companies, it’s extremely unlikely that you will lose all of your cash if just one or two stocks go down. This causes index funding a great option for those who are risk-averse.

Another gift of indexing is that it’s a very tolerant investment strategy. Once you have invested in an index fund, there is nothing else you need to do other than sit back and watch your money grow. This can be extremely helpful for those who don’t have the moment or fuel to actively manage their assets.

If you’re looking for a low-risk, passive investment option, indexing may be right. Index funds

Understanding Indexsp.inx

When you’re prepared to start selling products, one of the foremost items you need to do is understand indexsp: .inx. This file is a list of all the products that are traded on the stock call. It has the stock’s ticker symbol, business name, and corporation. The indexsp. in the file is updated daily, so you always have the most up-to-date information.

To learn more about a typical stock, look up its ticker sign in the indexsp.in file. This will show you the stock’s current price and other important details. You can also use the indexsp: .inx file to determine which stocks are traded on which exchanges. This can be helpful if you’re examining specific goods but don’t know which business it’s traded on.

The indexsp. in a file is essential for anyone who wants to trade products. By comprehending how to utilize this file, you can get started on your way to becoming a thriving investor.

Why indexsp: .inx It is the Fortune of Passive Investing and Wealth Building

indexsp: .inx is the future of passive investing and wealth building for several bases:

1. It shows investors a simple, low-cost way to invest in various products and other protection fields.

2. It is highly diversified, meaning that it provides investors with exposure to a large number of other companies and industries.

3. It is rebalanced periodically, ensuring investors are always invested in the most promising companies.

4. Low fees make it an ideal investment for building long-term wealth.

The Benefits of Choosing indexsp: .inx

Indexsp. in is a great way to navigate the stock market because it offers several advantages that other methods cannot provide. For starters, Indexsp. It lets investors follow real-time product prices across all major exchanges, allowing them to make informed asset decisions fast and efficiently. Additionally, Indexsp. in provides access to historical data and charts for each stock, making it easy to see how a particular security has performed over the period. Finally, Indexsp. in x’s user-friendly interface makes it simple for even the most novice investor.

Conclusion

As you can see, funding in the stock call with indexsp: .inx is a wonderful way to diversify your portfolio and control risk. Its low cost, user-friendly interface and easy access to financial data make it an excellent choice for beginning investors who want to learn the ropes of stock trading. For additional experienced traders, this method can provide a suitable way to follow their portfolios quickly across numerous needs and increase their profits through active management plans. Regardless of your experience level or goals, indexsp: .inx is here to help you reach them by providing affordable access to powerful tools to make navigating the stock market easier.